Search for statistical reporting forms by tax identification number. Mandatory reporting to Rosstat. Where to find this service

The territorial statistics office requests most reporting forms and information independently. That is, it is transferred to the address of the institution (deliberately, by mail, in electronic request) form that must be completed and returned. The composition of reports to Rosstat was adjusted more than once in 2019.

For example, in the public sector, the frequency of “ZP” reports has been changed in terms of the social and scientific spheres of activity. Note that previously reports of the types ZP-education, ZP-science and ZP-health were submitted quarterly. Now they have become monthly.

Due to the huge number of controlled entities, Russian statistics do not always have time to send requests to all recipients. However, the absence of an information request does not exempt an organization from mandatory reporting to Rosstat in 2019. For this, the institution faces a large fine under Article 13.19 of the Administrative Code.

In order to prevent administrative penalties, Rosstat strongly recommends checking the reporting on the TIN. We'll tell you how to do this later.

Rosstat - reporting by TIN: verification algorithm

Identifying the full composition of statistical reporting will not take much time. To carry out Rosstat verification of TIN reporting, you only need a computer with access to the Internet and your organization’s TIN.

The first step is to switch to the official electronic portal: Rosstat - reporting of organizations by TIN. Appearance The website page looks like this:

Step two - we enter the details of the organization in order to check on the Rosstat website which reports to submit using the TIN. If the company’s TIN is unknown, then information can be obtained from OKPO or OGRN.

Step three - click the “Get” button. It is located directly below the fields for entering subject identification information. The system analyzes the entered details and almost instantly produces search results.

So, let's analyze the information received. The first part of the generated search results contains the registration codes of the economic entity. These codes are also contained in the Letter from Rosstat, which is sent to the organization upon initial registration. If the letter is lost, the codes can be checked here.

Please note that the list discloses information not only about the name and frequency of provision of statistical reporting. In this section you can download current report formats for filling out in electronic form.

At the very end of the page, you can export the received information.

In simple words, an organization can download a list of reports or re-prepare and print a letter with codes from Rosstat.

Rosstat: financial statements

The deadline for submitting accounting reports is no later than three calendar months from the end of the reporting period. That is, no later than March 31 of the year following the reporting year. You can submit accounting information on paper (in person or by mail) or fill out an electronic form and send accounting records via secure communication channels.

All provided data is carefully double-checked. Inaccurate information provided may result in a fine. What is a report to Rosstat?

General points

Entrepreneurial activities vary in types and forms. Depending on the affiliation of the enterprise, the submission deadline and reporting form to Rosstat are approved for it.

Many entrepreneurs cannot understand the nuances of drawing up and filling out statistical reports.

First of all, because it is difficult to find clear instructions and you have to act at random. And besides, not everyone correctly understands what it is, report to Rosstat /

Thus, someone who is responsible for providing statistical data, but fails to provide it in a timely manner, is punished with a fine of thirty to fifty minimum sizes wages.

After the recent tightening of punishment, the fine for violating deadlines ranges from ten to seventy (). Submission of knowingly false data is punishable in exactly the same way.

Features of document submission

In accordance with changes in legislation, entrepreneurs and organizations must provide statistical reporting to territorial statistical bodies.

In this case, you can submit reports in one of three possible ways:

- in paper format;

- in electronic form;

- via mail.

The deadline for submitting annual statistics is March 31. If Rosstat employees identify some violations in the reports provided, they are obliged to notify the organization about them within five days and ask them to eliminate the errors.

Subject economic activity after receiving notification of violations, he must correct the document within two working days.

Do I need to take the IP?

Absolutely all individual entrepreneurs, without exception, are required to submit statistical reports. Even if an individual entrepreneur uses, this does not exempt him from submitting statistical reports.

The form of statistical reports for individual entrepreneurs is somewhat different - they should only provide material indicators of the results of activities.

This procedure was regulated and approved in July 2009.

More individual entrepreneurs are required to send data to the territorial statistical bodies about the industry to which the activity being carried out belongs.

Partially provided individual entrepreneur reporting is considered at the regional level, but a significant part of it is sent to Rosstat and participates in the preparation of federal reporting.

Video: how to send reports to Rosstat

An individual entrepreneur must independently find out from the territorial bodies of Rosstat which reporting forms he must submit.

This is necessary to avoid violations associated with failure to provide the necessary reports. Government Decree No. 620 obliges Rosstat employees to give the individual entrepreneur all necessary information for submitting reports.

That is, the entrepreneur must be informed about reporting forms, deadlines for their submission, and rules for drawing up.

What reports are required to be submitted by LLCs?

Statistical reporting for LLCs varies depending on the type of activity, production volume, and number of employees.

But at the same time, the LLC must submit:

In order to accurately determine which statistical reports should be submitted, you need to contact the territorial statistical authorities for clarification.

It should be taken into account that very significant regional differences may be observed between different subjects. In addition, not all enterprises must submit reports to Rosstat, but only those included in the annual sample.

Every year a new sample of observation subjects is formed, so LLC can be included in it in any year.

If an LLC operates under the simplified tax system, then reporting is not submitted. However, it is possible to be included in the sample, which requires mandatory submission of the specified reports.

When should it be submitted?

Form statistical reporting quite a lot, about three hundred different options. But not all of them are mandatory for any subject.

However, there are some forms that any enterprise that is not classified as a small business must submit. So in 2016, Rosstat is supposed to provide:

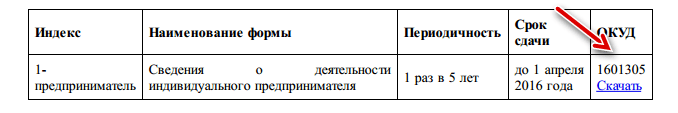

In addition to the above forms, some reports are required for small businesses. Every individual entrepreneur must provide these:

| , containing data on the results of work | By the twenty-ninth day of the month following the end of the quarter |

| , about what goods or services the small enterprise produces | Until the fourth day of the month following the reporting quarter. The report is mandatory for all individual entrepreneurs whose staff exceeds sixteen people, but less than one hundred |

| Containing data on any activity of a small business, except agricultural - until the second day of March of the year following the reporting year | |

| Form 1-IP containing data on retail trade and activities in the field retail or provision of household services | Until the seventeenth of October of the year following the reporting year |

Micro-organizations must provide statistical authorities with data on indicators characterizing the activities of the enterprise in the form of small business enterprises.

This must be done before the fifth of February of the year following the reporting year. By April 1, 2016, all small businesses must pass.

What is Rosstat

Organizations are required to submit:

- tax reporting,

- financial statements;

- statistical reporting.

The Federal State Statistics Service (Rosstat) is a body that generates official statistical information on social, economic, demographic and environmental situation countries.

Since April 3, 2017, Rosstat has been under the jurisdiction of the Ministry economic development Russian Federation. It is a very impressive service to match the tasks performed, approximately 18 departments, each of which has from 3 to 8 departments and services in the regions, for example the following divisions:

- Department of Price and Finance Statistics (Department of Statistics of Public Finance and Monetary System, Department of Statistics of Organizational Finance, Department of Consumer Price Statistics, Department of Producer Price Statistics);

- Department of Enterprise Statistics (Department of Continuous Surveys of Small and Medium Enterprises, Department of Structural Statistics and Macroeconomic Calculations, Department of Current Small Business Statistics, Department of Production Indexes, Department of Energy Statistics, Summary Information Department, Department of Statistics of Production of Intermediate and Investment Goods, Department of Statistics of Production of Consumer Goods goods).

The statistics service is designed to collect and analyze information. We are talking about the formation of an information base on the basis of which it is possible to make reasonable management decisions. It is approximately comparable to the information base of an enterprise, but on a national scale. This information is needed by authorities to improve tax, customs, and investment policies. According to statistics, you can understand how high the tax burden is on enterprises, what state this or that industry is in, how the state is developing, how the situation in certain areas of life is improving or worsening.

The activities of Rosstat are regulated by the Federal Law "On official statistical accounting and the system of state statistics in the Russian Federation" dated November 29, 2007 No. 282-FZ.

Who should report to Rosstat

Statistical reports must be submitted (Article 5 No. 209-FZ):

- organs state power and local government;

- legal entities of the Russian Federation;

- individual entrepreneurs;

- branches and representative offices of Russian organizations.

Further we are talking only about 2-4 categories of accountable persons. So, the law distinguishes small, medium and big business, who is required to submit statistical reports. Who is a small business? The law defines the categories for classifying companies and individual entrepreneurs as small and medium-sized businesses (with Vol. 4 Categories). The basic requirements are:

- Share of participation of other Russian legal entities in the authorized capital of LLC cannot be higher than 25%, and the share of foreign companies - 49%;

- The number should not exceed the limits specified by law: for micro-enterprises no more than 15 people, for small ones - maximum valid value 100 people, for medium-sized - no more than 250 people;

- Annual income should not exceed the limits: micro-enterprises - 120 million rubles; small enterprises - 800 million rubles; medium-sized enterprises - 2 billion rubles (Resolution of the Government of the Russian Federation dated April 4, 2016 No. 265).

How to check if a company is a small business

Companies that are not small and medium-sized businesses submit basic statistical reporting and additional reporting, which depends on the area of activity. To finally understand whether your organization is a small business, use the tax service service "Small Business Register". We wrote in a separate article how to get into it - how to check the presence of a company in the small business register.

How to find out about reporting to Rosstat by TIN

It’s easy to get a list of reports to Rosstat for your enterprise:

- Let's find out the TIN of the enterprise ();

- We go to the statistical parity service of Rosstat , enter your details and receive a list of reports for the organization.

The service has been operating since February 2017, generating a list of statistical reporting forms that a specific legal entity must submit, indicating their name. Information on the site is updated monthly. If questions arise, the organization can contact the territorial body of Rosstat with an official written request for a list of reports (clause 2 of Rosstat’s letter dated January 22, 2018 No. 04-4-04-4/6-smi).

Examples of reporting to Rosstat

On the Rosstat website you can see a list of all forms of statistical observation, but it is quite difficult to parse it in relation to yourself. We do not provide here full list forms, it changes regularly. There are quite a few forms of statistical reporting. The popular SPS Consultant Plus tried to assess the scale of statistical reporting and created the Stat Calendar service. reporting

For example, there is one of the many documents, Rosstat Order No. 461 dated July 27, 2018, it talks about the need to submit the following reports:

some annual reports from the 2018 report:

- 1-enterprise "Basic information about the activities of the organization";

- MP (micro) - type “Information on the production of products by a micro-enterprise”;

- MP (micro) "Information on the main performance indicators of a micro-enterprise"

monthly from the January 2019 report:

- 1-DAP "Survey of business activity of organizations of mining and manufacturing industries providing electricity, gas and steam, air conditioning"

quarterly from the report for January - March 2019:

- 1-NANO "Information on the shipment of goods, works and services related to nanotechnology";

- PM "Information on the main performance indicators of a small enterprise."

quarterly from the report for the first quarter of 2019:

- DAP-PM "Survey of business activity of small enterprises in mining and manufacturing industries providing electricity, gas and steam, air conditioning";

- 6-oil "Information on the cost of oil production, production of petroleum products";

weekly from the report for the 1st week of January 2019:

1-motor gasoline "Information on the production of petroleum products"

with a frequency of 1 time in 3 years for the report for 2018:

9-APK (meat) "Information on the processing of livestock and poultry and the yield of meat products."

Penalties for failure to submit statistical reports

If one of their many statistical forms is not submitted to Rosstat or submitted on time, the fine for the organization is 20-70 thousand rubles, for the manager 10-20 thousand rubles. (Article 13.19 of the Code of Administrative Offenses of the Russian Federation). Statute of limitations - 2 months. Below are the answers from Rosstat regarding the operation of this service.

Official responses from Rosstat on the operation of the statistical reporting list service

Answers from Rostat letters dated February 17, 2017 No. 04-04-4/29-SMI and dated July 26, 2016 N 04-04-4/92-SMI were used.

- Is official data posted on the resource statreg.gks.ru? Yes, official data is posted in the resource statreg.gks.r.

- How can you find out exactly whether a company is required to submit a form or not? The list of federal statistical observation forms is compiled as of the end of the year preceding the reporting year, with monthly updating in connection with structural changes in business entities (liquidation of enterprises, creation of new ones, reorganization, change in the status of an organization, etc.). Existing organizations should receive information about the list of federal statistical observation forms at the end of the year preceding the reporting year; newly created organizations should check the information monthly during the first year of their creation. If the respondent is not on the list, reporting is not provided, unless the organization has been notified in writing.

- Do Rosstat employees themselves use this resource to find out who is required to submit which forms? Yes, employees of Rosstat and its territorial bodies use the above resource.

- If on statreg.gks.ru the form is listed as mandatory, and the statistics agency has confirmed in writing that it is not necessary to submit it, does this exclude a fine for failure to submit the form?

If the organization has been informed in writing that the form does not need to be submitted, no penalties will be imposed on it.

- How to use the new service? The entrepreneur must enter his OKPO and TIN codes, as well as his state registration number (OGRN or OGRNIP). After this, a list of mandatory reporting forms is downloaded to the user’s computer automatically. The same table provides the frequency and deadline for submitting reports, as well as links to Rosstat pages where you can download their forms for filling out for free. The system works even if the user has entered only one of the above search parameters, however, in this case, the list of reports may be incorrect.

- Why does the information on statreg.gks.ru change: one day one, two days later another? Is this related to the update system? How does it update? The information retrieval system was developed in 2016 in order to promptly inform business entities about their provision of statistical reporting forms. The list of federal statistical observation forms posted in the specified system for respondents is compiled as of the end of the year preceding the reporting year, with its monthly updating. The monthly updating of lists of forms in the system is due to ongoing structural changes in business entities (liquidation of enterprises, creation of new ones, reorganization, change in the status of an organization, etc.), as well as the frequency of providing statistical reporting forms (monthly, quarterly, semi-annual). Existing organizations should receive information about the list of federal statistical observation forms at the end of the year preceding the reporting year; newly created organizations should check the information monthly during the first year of their creation. Considering the importance of this service for respondents, in the first half of 2017 Rosstat will make significant improvements to the interface aimed at optimizing and increasing the stability of its operation.

- Why are “unnecessary” forms included in the lists on statreg.gks.ru? What should companies do? Lists of federal statistical observation forms to be submitted by respondents are formed on the basis of statistical methodology, taking into account the types of economic activities of the organization, including all those declared at state registration. A number of federal statistical observation forms, according to instructions for filling them out, are provided only in the presence of an observed event. Providing “zero” reports for the reporting period on such forms is not required, and the absence of a report is qualified as the absence of a phenomenon by the respondent. For federal statistical observation forms, the instructions for completing which do not contain a requirement to provide data only if a phenomenon exists, it is possible for respondents to inform the territorial bodies of Rosstat in the constituent entities of the Russian Federation with an official letter about the absence of indicators for specific forms of statistical reporting instead of providing “zero” reports (in in the absence of a phenomenon).

- Which companies does Rosstat send letters with a list of reports to? To those who were included in the sample? In accordance with paragraph 4 of the Regulations on the conditions for mandatory provision of primary statistical data and administrative data to subjects of official statistical accounting, approved by Decree of the Government of the Russian Federation of August 18, 2008 No. 620, territorial bodies of Rosstat are obliged to inform (including in writing) respondents about carrying out federal statistical observation in relation to them. Informing respondents is carried out by posting lists of reporting forms in the information retrieval system. The sending of an information letter about the conduct of federal statistical observation in relation to an economic entity is, as a rule, carried out to respondents included in sample surveys.

- What should those who received a letter from statistics with a list of forms do, but some of the reports from the list are not on the site? Submit a report or clarify information with a statistics agency? How can I clarify? Organizations included in sample surveys may be notified in writing by state statistics bodies about the provision of specific forms of federal statistical observation. If the list of reporting forms published for the respondent at statreg.gks.ru differs from the one sent to the organization in writing, the written notification should be followed. If it is necessary to clarify questions about filling out and submitting federal statistical observation forms, organizations can contact the territorial body of Rosstat in the constituent entity of the Russian Federation at the location of the organization.

- What should companies do to avoid fines? Should I contact the statistics agency in writing? How to prove that we did not miss the deadline, but did not know about the report, since it was not on statreg.gks.ru? If the organization is not on the list published on statreg.gks.ru, penalties under Article 13.19 of the Code of Administrative Offenses of the Russian Federation are not applied, except in cases where the respondent, in the manner provided for in paragraph 4 of the Regulations, was informed (including in writing) about carrying out federal statistical observation in relation to him according to specific forms of federal statistical observation mandatory for submission. "Screenshots" are only valid evidence if they contain certain data, e.g. they indicate the date and time of receipt of information from the site on the Internet, contain data about the person who displayed it on the screen and subsequently printed it, data about software and the computer equipment used, name of the site, belonging to the applicant. Thus, if these requirements are met, “screenshots” can serve as supporting documents.

Firmmaker, February 2017

Evgeny Morozov

When using the material, a link is required

Who must submit statistical reports in 2017

In addition to mandatory tax and accounting reporting, companies and individual entrepreneurs must report to Rosstat. Small and micro enterprises have an advantage over large companies and may be completely exempt from the obligation to submit statistical reports. We will tell you in this article how to find out about the composition of the reports that your company needs to submit based on the results of 2016, and when to send them to the statistical authorities.

What to submit to Rosstat?

Companies that are not small and medium-sized businesses submit a certain set of statistical reports. There are mandatory forms, and there are those that depend on the area of activity.

In 2017, Rosstat Order No. 414 dated August 11, 2016, which approves the main forms of statistical observation, remains relevant and in force. This document contains forms for both small and micro enterprises, and for legal entities not falling into these categories. There are also Rosstat orders approving specific forms. For example, the annual form 1-Enterprise was approved by Rosstat Order No. 691 dated December 9, 2014, and Rosstat Order No. 498 dated October 26, 2015 approves five forms at once.

Basic forms that non-small businesses must submit:

What does Rosstat expect from small businesses?

As mentioned above, such businessmen most often submit reports to Rosstat using a simplified scheme, and some do not report at all.

The obligation to submit statistical reports for small and medium-sized businesses is enshrined in Art. 5 Federal Law dated July 24, 2007 No. 209-FZ. The same law defines the criteria for classifying companies and individual entrepreneurs as small and medium-sized businesses. The basic requirements are:

1. The share of participation of other Russian legal entities in the authorized capital of the LLC cannot be higher than 25%, and the share of foreign companies - 49%.

2. The number of employees should not exceed the limits specified by law: for micro-enterprises no more than 15 people, for small enterprises - the maximum allowable value of 100 people, for medium-sized enterprises - no more than 250 people.

3. Annual income should not exceed the limits: micro-enterprises - 120 million rubles; small enterprises - 800 million rubles; medium-sized enterprises - 2 billion rubles (Resolution of the Government of the Russian Federation dated April 4, 2016 No. 265).

Rosstat conducts two types of monitoring of the activities of companies and individual entrepreneurs: continuous and selective.

Continuous surveillance for small and medium-sized businesses is carried out every five years. Last time it was carried out in 2015. In 2016, small companies and individual entrepreneurs submitted the MP-SP and 1-Entrepreneur forms, respectively, based on the results of the previous year. If the legislation does not change, the next continuous observation will be small and medium business based on the results of 2020. Usually Rosstat issues additional orders with the required forms and recommendations for filling them out; some companies receive the corresponding forms by mail.

Sample observation is carried out continuously, and reporting may change from year to year. You can find out whether your company is included in the sample on the Rosstat website or by calling the territorial statistics office. In addition, Rosstat must notify companies about being included in the sample in writing or orally. Territorial statistical authorities may request additional forms.

The most common forms submitted by small and micro enterprises and individual entrepreneurs are 1-IP, MP (micro) - in kind, PM, TZV-MP, etc.

Advice! If you do not know what reports to submit to the statistical authorities, check with your territorial office by phone. This will help your company avoid fines.

Mandatory reporting to Rosstat

Regardless of the number and type of activity, all companies that are required to prepare accounting (financial) statements must submit a copy of it to the territorial statistics body before March 31 (for 2016 until 03/31/2017). This obligation is enshrined in Art. 18 Federal Law dated December 6, 2011 No. 402-FZ.

If you do not submit your financial statements on time, the company may be fined 3-5 thousand rubles, and its director - 300-500 rubles (Article 19.7 of the Code of Administrative Offenses of the Russian Federation).

Responsibility for violation of deadlines

Statistical reporting can be submitted on paper or electronically (the method of submission is usually indicated on the form).

Violation of deadlines for statistical reporting or failure to submit it is punishable by serious fines (Article 13.19 of the Administrative Code):

- the company will pay from 20 to 70 thousand rubles;

- the manager will pay from 10 to 20 thousand rubles.

Repeated violations can cost the manager 30-50 thousand rubles, and the company 100-150 thousand rubles.

Good afternoon, dear individual entrepreneurs!

In addition to reports on taxes and contributions, individual entrepreneurs must periodically submit reports to Rosstat. Unfortunately, there is no single and constant list of what and when an individual entrepreneur must submit to Rosstat. The fact is that this list completely depends on what exactly the individual entrepreneur does and is constantly changing, as new reporting is regularly introduced. Fortunately, most individual entrepreneurs do not submit statistical reports very often.

Yes, once every 5 years individual entrepreneurs submit reports on continuous observation. Rosstat sent out notifications to everyone by mail with a ready-made form to fill out. You can also find out what statistical reports need to be submitted when using online accounting services or in “1C”.

By the way, I constantly encourage the use of accounting programs for tax (accounting) accounting, since the developers of such programs regularly update them and upload the necessary reports.

But now an official service has appeared, with which you can quickly check yourself. The service is as simple as the truth.

Where can I find this service?

Update. The service has changed and is now located at a new address:

There was a problem with the https protocol in the video, but it has now been fixed.

I remind you that you can subscribe to my video channel on Youtube using this link:

P.S. Below we describe how to use the old version of the service. But since it has been updated, I advise you to watch the video above.

- In the drop-down list, select “Notification for individual entrepreneurs...”

- Enter your OGRNIP and click on the “Search” button

Then click on the “List of Forms” button

And download the PDF file, which will indicate that you need to take the IP.

For example, I got this result:

This is the same continuous observation questionnaire that all individual entrepreneurs took at the end of 2015. The form itself can be downloaded from the link in the document.

P.S. Check yourself regularly to avoid possible problems. Better yet, use programs accounting(the same “1C: Entrepreneur”), where all these statistical reports are generated automatically. By pressing a few buttons. Requests from Rosstat for reporting cannot be ignored, as a significant fine will follow.

P.P.S. Screenshots are from the website http://statreg.gks.ru/

Don't forget to subscribe to new articles for individual entrepreneurs!

And you will be the first to know about new laws and important changes:

Dear entrepreneurs!

New one ready e-book for taxes and insurance contributions for individual entrepreneurs on the simplified tax system 6% without employees for 2019:

"What taxes and insurance premiums does an individual entrepreneur pay under the simplified tax system of 6% without employees in 2019?"

The book covers:

- Questions about how, how much and when to pay taxes and insurance premiums in 2019?

- Examples for calculating taxes and insurance premiums “for yourself”

- A calendar of payments for taxes and insurance premiums is provided

- Common mistakes and answers to many other questions!

Dear readers!

Ready detailed step by step guide for opening an individual entrepreneur in 2019. This e-book is intended primarily for beginners who want to open an individual entrepreneur and work for themselves.

This is what it's called:

"How to open an individual entrepreneur in 2019? Step-by-step instructions for beginners"

From this manual you will learn:

- How to properly prepare documents for opening an individual entrepreneur?

- Choose OKVED codes for individual entrepreneurs

- Choosing a tax system for individual entrepreneurs ( brief overview)

- I will answer many related questions

- Which supervisory authorities need to be notified after opening an individual entrepreneur?

- All examples are for 2019

- And much more!